The only AI benefits platform for employees and HR

A single, trusted source of truth

Avante unifies fragmented benefits data, including claims, vendor performance, financial data, and employee inquiries – so you have the data at your fingertips to make smarter decisions.

The insights you need to run smarter

Deliver a world-class employee experience while containing costs. Optimize plan design, vendor selection, and wellness campaigns – with AI insights into the utilization, financial impact, and outcomes across your entire benefits program.

More engaged, productive employees

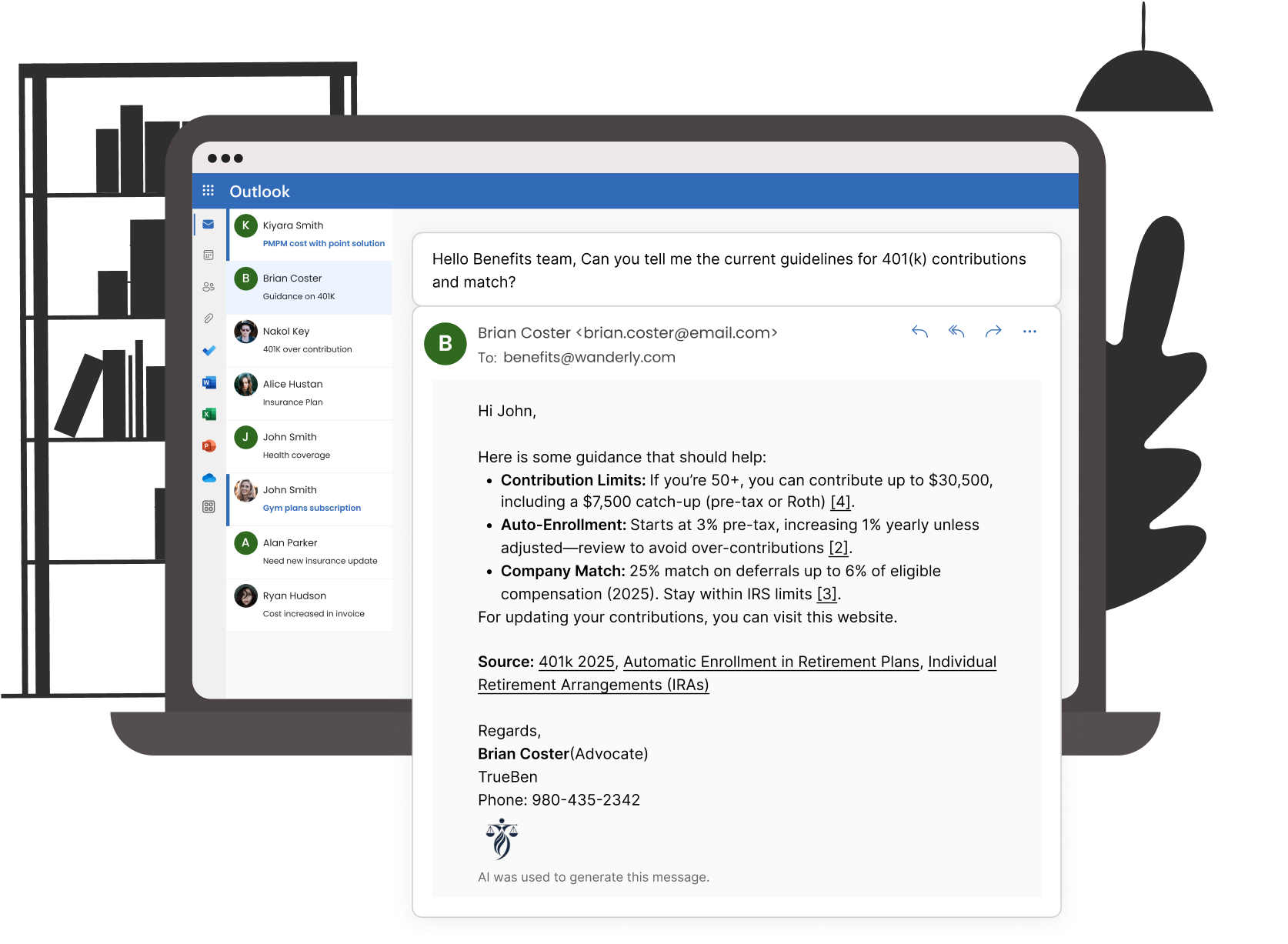

Meet the first personalized, context-aware AI benefits agent. Avante delivers trusted 24/7 guidance to employees to help navigate every question from open enrollment to LOA and 401(k).

Your AI companion for scaling operations

Multiply your team’s productivity and scale effortlessly—without adding headcount. Avante integrates with your team’s existing tools and answers employee questions right the first time so you can get more done.

A feedback loop from hire to retire

Understand exactly what your employees need to be at their best. Capture insights on employee sentiment and benefits gaps to inform plan design, vendor selection, and campaigns.

Avante’s impact by the numbers

7x

improvement

in employee benefits engagement versus the industry standard

40%

reduction

in HR workload – so you can scale cost-effectively

~3%

decrease

in healthcare cost trend through AI-powered insights

“Avante was incredibly helpful for selecting my benefits this year, particularly in considering the cost (which was critical given a change in a previous stipend for medical plans that we received last year). Knowing I have this tool to navigate questions that may come up as I navigate this new type of plan beyond open enrollment also made me more comfortable to choose it.”

Young professional, 27, exploring benefits & coverage options